One of the many unwelcome consequences of the dramatic increase in Middle East tensions since last autumn has been a surge in potential new pressure points for global supply chains – a fear made more acute by the fact that supply problems accruing during the three previous years relating to Covid have only recently subsided.

In particular, the sudden restriction of access to Red Sea routes was bound to have a significant impact on the transportation of goods. Recent JP Morgan research revealed that 30% of global container trade passes through the Suez Canal – the artificial waterway that connects the Red Sea to the Mediterranean Sea – while shipping costs on some cargo routes have surged nearly five-fold in recent months.

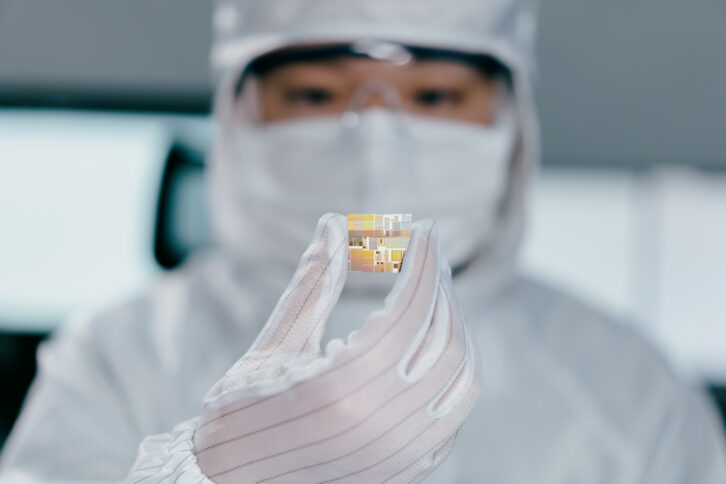

Simultaneously, tensions in East Asia have continued to rise in light of China’s stated wish to re-unify Taiwan – which has been governed independently since 1949 – with the mainland. Conflict in this area would be especially challenging for the AV technology industry as Taiwan possesses a huge market share of the global semi-conductor foundry market – more than 61% according to a recent study issued by Statista.

Meanwhile, you don’t have to look far for other potential flash-points – from an increasingly hawkish North Korea to Russia’s ongoing war in Ukraine, where there are legitimate fears that tactical nuclear weapons could still be used. All of which could, of course, have catastrophic implications for trade – literally overnight.

Despite this, the mood of those who spoke to Installation for this supply chain update was generally positive. A renewed commitment by manufacturers and distributors to building inventory has meant supply times are much improved from the peak-Covid period. Meanwhile, there are also plenty of fresh initiatives – from the development of alternative components to new chip factory projects and EU legislation – that promise to reduce the impact of further crises.

GOOD SHAPE

Peter Hansen, economist at AVIXA, comments: “For pro AV, the supply situation is in increasingly good shape. Yes, there are new issues: Houthi attacks reducing traffic through the Red Sea and the ongoing closure of the Port of Baltimore in the US [due to a bridge collapse in March 2024]. But the reality is things were so bad for so long that issues like these can’t compare. The data shows supply difficulties continue to resolve and fade into the background. For example, in our most recent monthly pulse survey (March 2024), just 7% of respondents identified supply constraints as their biggest challenge. That’s down from 36% a year ago in March 2023, and down from 18.4% six months ago in September 2023.”

“Immense challenges” during the pandemic meant that supply issues became more familiar, although Hansen says that “in normal times supply chains are fairly robust. Between all stages of the chain – manufacturer, distributor, integrator – there are usually two to three months of supply available.”

Nonetheless, AVIXA continues to make supply chains an important facet of its research work. It published “two major deep dives” into the topic during the pandemic, whilst a monthly “pulse check” in the Pro AV Business Index keeps an eye on “how difficult supply is in the mix of challenges for AV companies”. Supply challenges are also a key component of AVIXA’s Industry Outlook and Trends Analysis (IOTA) research, which measures industry revenue by vertical market, solution area, product and geography.

STOCK LEVELS

Toni Moss, managing director of systems integrator Strive AV, is among those to suggest that, in the wake of the pandemic, important lessons have been learned across large swathes of the industry.

“I think that a lot of the distributors and manufacturers have realised they don’t ever want to get into the situation they had a couple of years ago,” she says. “So first and foremost their stock levels are definitely higher than they used to be. There were some manufacturers where previous supply problems must have had a serious impact on sales and turnover, and it’s a matter of debate as to if and when they can regain lost customers. So I think there has been a real change in terms of having larger stocks available at one time, whilst more coordination on the delivery side – for example, with regard to a supplier making all the deliveries in one area during the same time-period – has also improved the situation.”

Consequently, Moss says that lead-times for the projects Strive AV has worked on this spring – which include a flurry of university and college installations, as well as an increasing number of commitments in the corporate world – have generally been fairly short. Alluding to a recent AV modernisation effort at the University of Sussex Business School, Moss says that “was a really big project and we basically received all of the stock we needed within three weeks” – in other words, the kind of lead-time that would have been commonplace before 2020.

Brad Hintze, EVP of global marketing at Crestron, also indicates that increased industry pro-activity is proving beneficial. “Supply chain experts have warned about disruptions like this for over a decade, even beyond our industry,” he says.

“The pandemic created a perfect storm for everyone to feel those disruptions directly. One good outcome is that everyone is now taking this more seriously and is anxiously engaged in looking for long-term solutions. We have gotten much closer to key partners; rather than just being a customer that buys components, we now actively have dialogues to find new solutions. We hope everyone in the industry stays engaged in these types of conversations and will continually look for new ways to partner and build greater technologies.”

For Crestron, Hintze says there has been a return to a “steady product flow” into warehouses and out to customers: “Some individual components continue to have longer than usual lead times, but we have been proactively planning in such a way that it is not impacting our ability to build and ship products. We have gotten better at forecasting demand and, in many cases, maintaining higher-than-normal levels of inventory in our warehouses.”

The company also maintains its policy to “continually evaluate” manufacturing operations and partners. “In many cases, we have started to build in choice/flexibility in the components we use on key products; in others, we have started to identify key products that must always be in stock and build up safety stock with product on our shelves.”

AV stakeholders can also take encouragement from broader industrial and political moves to improve technology supply resilience. In the US, Joe Biden’s administration recently announced new funding for a computer-chip factory in New York state, while a cluster of semiconductor facilities are in the planning stages in Europe in the wake of the EU European Chips Act that went into force last September. Staying in the EU, the recent passage of the Critical Raw Material Acts also looks set to be an important development.

Writing on X (formerly Twitter), professor and senior expert at the European Commission, Dr Cristina Vanberghen, described the act as a “significant step forward for Europe’s pursuit of strategic digital autonomy and resilience in the face of supply chain vulnerabilities. The act addresses pressing concerns stemming from supply shortages during the pandemic and escalating geopolitical tensions, underlining the imperative for Europe to reduce its dependence on external sources for critical materials.”

SILICON ALTERNATIVES

There is also a growing interest in pursuing alternatives to silicon-based chip production. For example, Installation recently reported on nanotechnology company Chiral’s announcement of a US$3.8m funding round to address the challenge of silicon-based chip shortages, innovating the way nanomaterials are integrated into devices. More generally, the prospect of the industry hitting a ceiling in terms of silicon technology capacity is also sparking increasing interest in nanomaterials like carbon nanotube and graphene.

Still, with the timescales for developing new silicon chip foundries, in particular, bound to be distinctly protracted, it’s just as well to remain vigilant – especially in a world where peace feels more precarious than at any time since 1945. Futuresource Consulting’s head of professional displays and principal analyst, Ted Romanowitz, implies that uncertainty itself constitutes an ongoing challenge.

Still, with the timescales for developing new silicon chip foundries, in particular, bound to be distinctly protracted, it’s just as well to remain vigilant – especially in a world where peace feels more precarious than at any time since 1945. Futuresource Consulting’s head of professional displays and principal analyst, Ted Romanowitz, implies that uncertainty itself constitutes an ongoing challenge.

“There are so many variables when you look at it – from a military perspective, from a political perspective, there is so much going on in the world that could potentially impact the supply chain,” he says, alluding to recent research suggesting that, in some areas of tech, “the people actually making the purchase decisions are being ultra-cautious” There is also the issue of inflation, which is affecting the “ability to get capital and invest in infrastructure, whilst we also have critical elections taking place in several countries”. He adds that this could have some real impacts in terms of how governments view international business.

In short: it’s best to stay on your guard during a period of instability that Romanowitz compares to the notoriously uncertain era of the late 1960s and early 1970s. But if it’s impossible to fully prepare for every conceivable scenario – remember everyone, EMP means there’s likely to be no mains power after a full-scale nuclear war! – then at least pro AV seems to have taken onboard valuable lessons about inventory building and contingency planning that will serve it well during any future crises.